54+ how many months behind on mortgage before foreclosure

The borrower has abandoned the property the borrower hasnt responded to the servicers outreach attempts for 90 days or. As an example you will have to pay 50 late fee on a 1000 mortgage payment if you go over 15-days late.

G136892km15gi008 Gif

Web In Texas pre-foreclosure begins with the lender sending a Notice of Default allowing the homeowner a grace period ranging from 2030 days to get current on their mortgage payments.

. Web 4 Months Behind on Mortgage Payments Missed Mortgage Payment Most mortgages and deeds of trust require the lender to send a breach letter before accelerating the loan and beginning a foreclosure. You may be worried about approaching them given how hard you worked to get a mortgage in the first place. Web You can usually be delinquent on your mortgage payment by 120 days before the foreclosure process begins.

After that once your servicer begins the legal process the amount of time you have until an actual foreclosure sale varies by state. Texas Department of Housing and Community Affairs. This period lasts for at least 120 days and starts when a homeowner is first late with a mortgage payment.

If the homeowner does not pay what they owe. Web From August 31 2021 through December 31 2021 unless an exception applies a loan servicer may start a foreclosure only if the borrower is over 120 days behind on their mortgage payments and. Web In general mortgage companies start foreclosure processes about 3-6 months after the first missed mortgage payment.

Web According to the FDIC 250000 new families enter foreclosure every three months. The laws overseeing foreclosure vary from state to state. Web The legal foreclosure process generally cant start during the first 120 days after youre behind on your mortgage.

Web Thus many times a borrower can fall behind a month or two without facing foreclosure. If you are having trouble making your mortgage payments act quickly. Foreclosure does not begin the moment you start missing mortgage payments.

First youll be referred to your lenders attorneys. Thankfully this is not the case. Web How Many Months Before Foreclosure.

At the end of the grace period you are normally charged a late fee about 5 of the amount of the missed payment. Web More than 3 million households are behind on their mortgage payments and nearly 17 million will run out their forbearance periods in September according to the bureau. As a result of your delinquency youll be required to pay any legal fees incurred during this time.

Usually the servicer sends the letter when youre around 90 days overdue on the loan. By law the acquisition process takes at least 120 days and you cant avoid this problem if you take action now and talk to your lender. The borrower has abandoned the property.

Web The pre-foreclosure period is the time before the foreclosure process begins. Web After youve missed the deadline provided in the demand letter and you are four months behind on your mortgage payments the foreclosure process will usually begin. But acting now is the best thing to do if you want to.

If havent reached an agreement or paid the amount due by the specified date in the letters sent the foreclosure process will start. There are ways to forestall the conventional and government lenders from starting a foreclosure which you can see on Fannie Mae and FHA and VA websites. Note that if a mortgage payment is late by a few days past the grace period it wont result in a.

Many people never contact their lender for help either out of embarrassment or because they fear that reaching out for help would cause them to lose their home even quicker. In nonjudicial states such as California where foreclosure. Web Your mortgage is due on the first of the month and is considered late after 15-days.

1 30 days past-due 45-65 points. Web Generally you do not have to move out until the foreclosure process is complete which can take a few months or up to a year or longer. At this point you will be four months or 120 days behind on your payments.

Late fees are charged after 10-15 days however most mortgage companies recognize that homeowners. The collections department will send reminders that you are behind on the mortgage. Web When Does the Foreclosure Process Begin.

Generally the process starts when you have missed payments for a total of three or four months. Web Missing Your Fourth Mortgage Payment. The borrower has abandoned the property the borrower hasnt responded to the servicers outreach attempts for 90 days or.

However once your house is sold you have to leave the. 3 Generally federal law prohibits a lender from starting foreclosure until the borrower is more. Foreclosure Prevention page and HOPE hotline.

Web Depending on the state and type of foreclosure you may have from 111 days to 12 months or more before your home is foreclosed. The borrower hasnt responded to the servicers outreach attempts for 90 days or. Web From August 31 2021 through December 31 2021 unless an exception applies a loan servicer may start a foreclosure only if the borrower is over 120 days behind on their mortgage payments and.

Federal law prevents loan servicers from foreclosing on a property until the borrower is more than 120 days late with their payments. Web If it is an FHA or VA loan they must show that they attempted to work with you and therefore will not start foreclosure on the 1st day of the next month. 1 30 days past-due 17-37 points.

However that can vary based on other factors including your lenders particular. Web 63-83 points. The good news is that if you take a risk with a mortgage loan you still dont have to worry about getting a mortgage.

Web From August 31 2021 through December 31 2021 unless an exception applies a loan servicer may start a foreclosure only if the borrower is over 120 days behind on their mortgage payments and. Web Legally it takes at least 120 days before the foreclosure process begins and you can often stop it from happening at all if you take action now and speak to your mortgage lender. Web You can find additional information about mortgages and foreclosures during COVID-19 below.

How Long From Last Mortgage Payment Till Foreclosure

If You Are Over Six Months Behind On Mortgage Payments Are You In Foreclosure Pocketsense

When Borrowers Default On Second Homes The New York Times

Banking Notes With Digests From Kriz P Cha Mendoza Pdf Foreclosure Loans

Seriously Delinquent Mortgage Loans Up 1 7 Million In 2020 Dsnews

What Is The Home Foreclosure Process How Long Does It Take

Studio 54 Wikipedia

Housing Market Goes Nuts Everyone Sees It But It Can T Last Wolf Street

How Far Behind On Mortgage Payments Can You Get Before Foreclosure

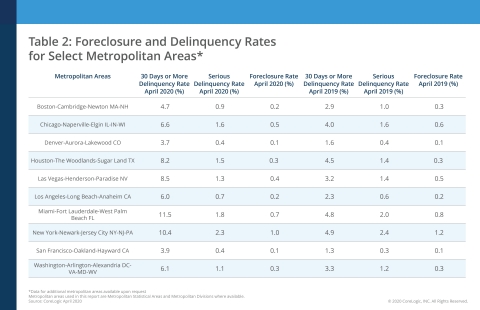

Hitting A Downslope Early Stage Mortgage Delinquencies Exceed Great Recession Levels In April Corelogic Reports Business Wire

December 01 2021 By The News Journal Issuu

How Many Months Of Mortgage Arrears Before Repossession Jan 2022

How Many Mortgage Payments Can I Miss Before Foreclosure Happens Gobankingrates

610 Ne Flower Mound Rd Lawton Ok 73507 Zillow

C Viile Weekly July 7 13 2021 By C Ville Weekly Issuu

:max_bytes(150000):strip_icc()/heir-c1f70350a1f8467fbdedbe1f6d5a4c51.jpg)

The 6 Phases Of Foreclosure

Pdf Mortgage Default Foreclosure And Bankruptcy